Polygon Insights #4

Hola readers! In the past week, EIP1559 went live, the Polygon Advocates program was launched and applications are now open for evangelists to join the Scalability revolution.

Let’s dive in. ⚡️

Key takeaways:

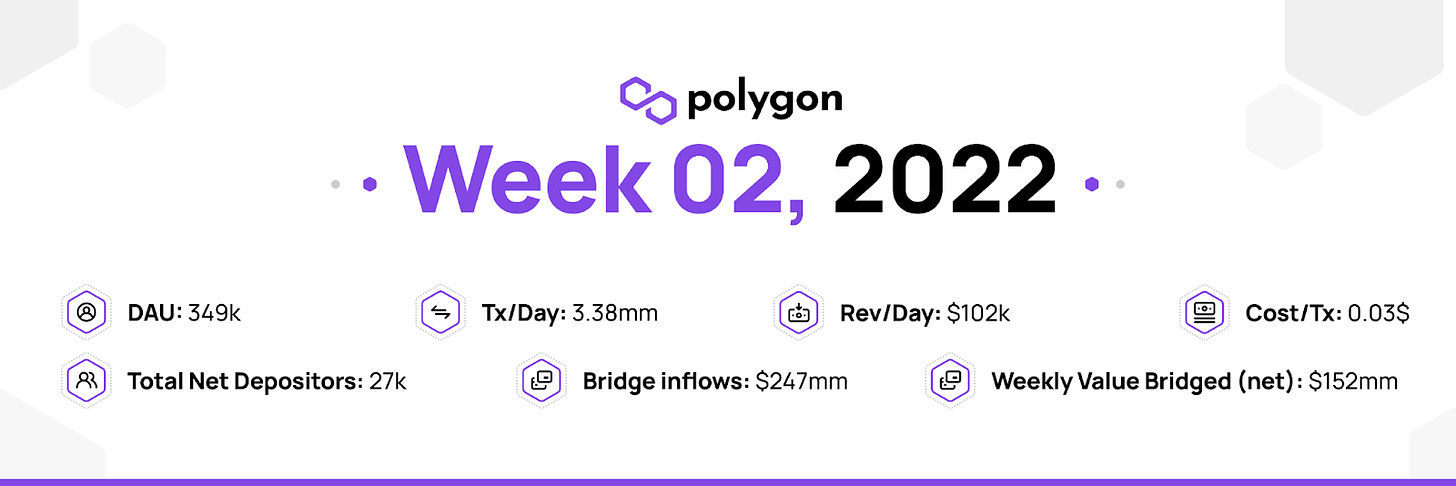

📈 DAU (349k): As predicted last week, we saw significant trace back from the explosive growth Sunflower Farm’s influence lowered. Week over week, active users dropped 28.9%, but a more accurate number would be the two week move, which just saw a 3% drop.

📊 Tx/ Day (3.38mm): Transactions continue to be relatively flat, on.y decreasing 5.6% week over week. Average transactions per user is stabilizing between 9-10 transactions, showing a very active user base.

💸 Rev/ Day ($102k): Revenues had two negative catalysts. Token price decreased 15% week over week, and total transactions dipped. Still, Polygon saw its fifth highest mark all time, at $102k per day.

⛽️ Gas Fee saved by using Polygon: $148 Million daily ($44 per Txn)

Detailed analysis on prev. week is here.

Our continued endeavour to facilitate Gaming and empower gamers has been strengthened through a partnership with IndiGG.

> The Uniswap v3 Polygon liquidity pools had by far the highest liquidity utilisation rates and is more capital efficient.

Learn more here.

> Skyrocketing gas fees on decentralized networks like Ethereum has been a great hindrance to the mass adoption of money market protocols like AAVE. Polygon with its robust infrastructure, growing market reserves, increasing market depths and higher yields has been successful to a great extent in incubating the optimal conditions for such mass adoption.

Learn more here.

For in-depth weekly analysis threads, view our Analytics resources on GitHub. View all the latest announcements and updates about Polygon on our Blog post.

We are happy to welcome you to our official Discord server or answer your questions via GitHub Discussions. Thanks for reading! 🤝